Sturgeon’s Regulation states, “90% of all the pieces is crap.” 1

Theodore Sturgeon was a science fiction author within the Nineteen Fifties and 60s. He was regularly aggravated by critics who dismissed the style primarily based on its worst examples. When requested, “Why is a lot science fiction so dangerous?” his reply turned often known as Sturgeon’s Regulation.

I’ve taken it upon myself to craft “Sturgeon’s Corollary,” which states the next:

“90% of all funding merchandise are crap.”

The explanation for this turns into clear throughout almost each kind of monetary product: Mutual funds, SPACs, hedge funds, non-public investments, ETFs — you title it. The easy reality is that beating a broad benchmark web of charges and taxes over a long-term funding horizon (5 to 10 years +) is extremely troublesome. Add excessive(er) charges, funding methods that fall out and in of favor, and human behavioral errors, and you’ve got a formulation that makes it troublesome to beat a largely listed portfolio.

This isn’t to say that there aren’t wonderful examples of all these merchandise. There are some great ETFs and a handful of excellent mutual funds. Many hedge funds, particularly these run by rising managers, quants, and multi-strategy retailers can and do generate alpha. Nevertheless, we have to acknowledge that choosing the funds that can outperform prematurely is a protracted shot. Solely a uncommon few maintain outperformance over the long run.

Sturgeon’s Corollary is very true in non-public markets. Personal credit score, non-public debt, and personal fairness have skilled super progress over the previous decade. This has resulted in a land seize, as many gamers rush into the house to safe property and charges.

For UHNW traders and RIAs on this house, there are 5 areas they need to concentrate on when contemplating including various investments to their platform.

- Uncorrelated returns

- Threat

- Survivorship bias

- Illiquidity

- Prices

Probably the most important attraction of other investments is the declare of uncorrelated returns versus publicly traded equities and bonds. Whereas one would possibly assume that the underlying financial cycle will influence all the pieces, there are situations the place this has confirmed to not be the case. That is probably the most favorable facet of personal options.

The second subject is danger, particularly leverage. Whereas we see many proposals displaying better-than-index-based returns, many have achieved this Alpha by way of extra leverage. On a risk-adjusted returns foundation, the outperformance typically disappears.

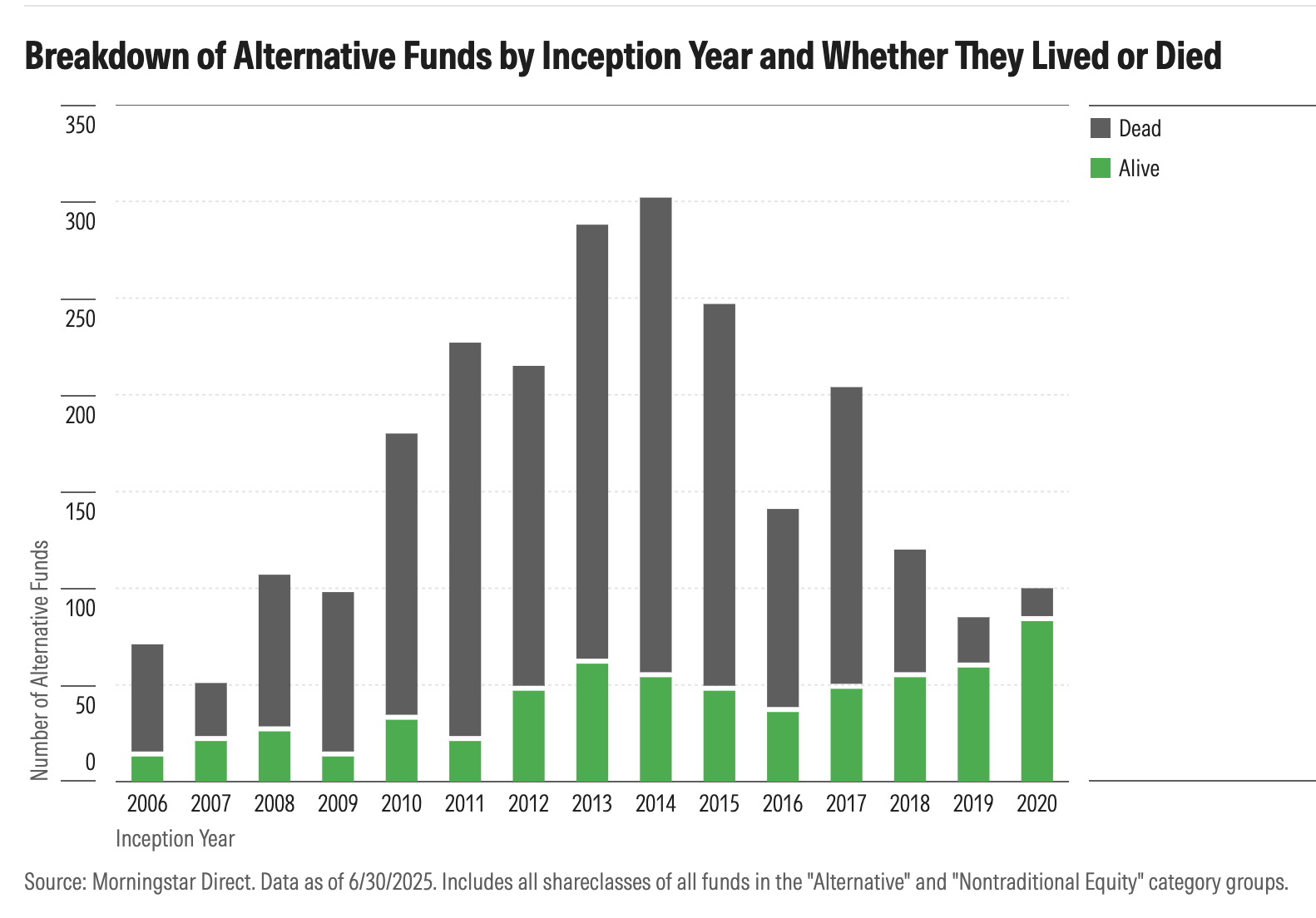

Illiquidity and prices are properly understood, so allow us to take into account survivorship bias. The latest evaluation of Jeffrey Ptak of Morningstar exhibits:

“On Jan. 1, 2015, there have been 1,345 various mutual funds in existence. Solely 341 nonetheless existed on June 30, 2025 – a 75% mortality price.”

That’s fairly a stat: Three out of 4 funds folded throughout a decade, with most going stomach up inside the first 5 years. This creates a scenario the place the remaining fund efficiency throughout your entire asset class seems higher traditionally than it’s prospectively, as a result of the standard fund that closes does so as a consequence of poor efficiency and an incapability to draw capital.

My perspective towards non-public investments has developed over the a long time; I imagine that for those who can entry the highest decile of funds, you completely ought to. Alternatives to spend money on the highest quartile also needs to be thought of. Something under that ought to be approached skeptically, as they are typically costly, illiquid, risk-laden, and underperforming.

I count on this will probably be a difficult space for traders over the subsequent decade. Excessive-net-worth traders have a tendency to listen to about the very best funds within the media whereas both ignoring or not studying about the remainder of the sector. As we now have seen elsewhere, mutual funds, ETFs, hedge funds, SPACs, and so forth, this isn’t a formulation for fulfillment.

Your mileage could fluctuate.

Beforehand:

10 Quotes That Formed My Funding Philosophy (October 2, 2023)

Why Most SPACs Suck (October 26, 2020)

90% of Every thing is Crap (July 25, 2013)

Sources:

75% of Various Mutual Funds Have Died. There Are Classes in That for Would-Be Personal Market Buyers

Jeffrey Chook,

Morningstar, Aug 11, 2025

The State of Semiliquid Funds 2025 (Morningstar 2025)

__________

1. See Effectiviology, which notes that Sturgeon formalized it additional within the March 1958 subject of Enterprise, calling it “Sturgeon’s Revelation.”